About eight or nine months ago I raised a point during a budget committee meeting: before legislating a fund balance policy, the Council should determine if the benefits of the Town's ever-growing fund balance were worth the costs. (I’ve described my concerns in great detail, see a few of the links here and here.)

In other words, while a rainy day fund is important… is it worthwhile to have a rainy day fund of $8,000,000 (8% of a $100,000,000 operating budget) instead of a rainy day of $5,000,000 (5%)? What is the benefit of the additional $3,000,000 taken from the taxpayers? And what is the benefit of maintaining that additional 3% at a cost of $90,000/yr?

Unfortunately, the Council did as I expected. That is, when I initially suggested a cost/benefit analysis, the Town Manager immediately rejected the idea. And though I’ve been advocating this idea since then… including doing my own cost/benefit analysis based on the information provided by the Town Manager… the Council did as I expected they would. Though they listened to hours and hours of testimony, they never documented the costs and benefits and never offered the information to the voters in a digestable form. This is a lack of oversight.

The fund balance is an accounting function. And accounting requires that you put pen to paper. So to not put pen to paper and document the rationale for the “8%” was a failure of leadership.

To his credit though, Matt Hall was very candid. He said the Democrats won the election. Herego, the voters disagreed with my call for a cost/benefit analysis. Of course, I could’ve argued that my reelection was a voter mandate for a cost benefit analysis, but the writing was on the wall a long time ago. If the Town Manager says something… don’t expect this Council to overrule him. (Anyone recall our recently created Public Information Officer position??)

Anyway, the conversation started off unsurprisingly. The same old story was being spun about how it’s impossible to measure the value of the rainy day fund. I pretty much figured that was how it would go, so I had pretty much already resolved myself to a “no” vote on this measure.

Instead I decided to simply use my expertise as a CPA to add some value to the conversation. And while Matt Hall protested that I was not the only CPA on the Council, I'm quite confident that I am the only Council member who is a CPA. I’m confident that any claims to the contrary are false. Furthermore, I’m pretty sure that I’m the only person sitting behind the dais who has any financial qualification. And for that reason, I felt the need to clarify the debate. After all, we’re talking about millions of taxpayer dollars. The least I can do is try to make sure this new policy makes sense from an accounting perspective because it is an accounting function.

And since there was no one behind the dais who was qualified to discuss the terminology of the “fund balance policy,” I asked the Town’s Finance Director, Patti Lynn Ryan, to work through the terminology with me. Although she didn’t have all the answers, she did do a good job and recognized the importance of the terminology being used, including:

terms often used by the town are “reserve” and “fund balance.” Terms used by others (GASB and GFOA) are “reserved fund balance” and “unreserved fund balance,” along with “designated unreserved fund balance” and “undesignated unreserved fund balance.”

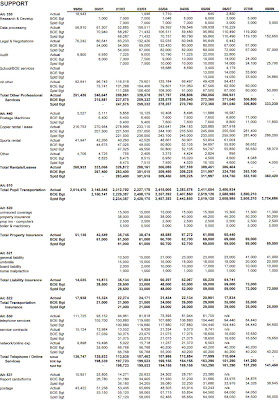

And since it’s possible that the town’s “reserve” is someone else’s “designated unreserved fund balance,” it’s possible that we may need to reclassify all of the Town’s “reserves” and include them in the town’s newly adopted “fund balance” policy.

In layman’s terms, that means the reserves currently set aside by the town would all be returned to taxpayers… perhaps in the form of a mill rate reduction this year? I’m not sure.

Nonetheless, the majority’s poor judgment in passing the legislation and rejecting my suggestion to table the motion and review the policy may prove to be a windfall for the taxpayers. To enforce the 8%-9% policy may soon require all those additional reserves to be returned to the taxpayers in some form.

Bottom line though… I knew I didn’t have the votes to reject this policy as written (I'd be happy if it were 5%, not 8%). I just wish that I could have found at least one member of the Council majority who felt that the additional $3,000,000 tax burden already levied and the additional $90,000/yr in ongoing tax burdens that will be levied needed to be justified in real dollar terms and documented for public consumption. Unfortunately, since it didn’t happen, I conclude that the benefit is not there… hence, the Council majority is comfortable with excessive taxation.

Tim White

Town Council, 4th District